LEADERSHIP STRATEGY: DO THE RIGHT THINGS AT THE RIGHT TIME

success depends on knowing when and where to invest or divest

Eli Goldratt, a world-class physicist, used his scientific prowess to study a failing manufacturing plant owned by his brother. Findings turned the business around and inspired Eli to write a best-selling book called The Goal where he introduced his “Theory of Key .Constraint.” Unfortunately, rigid organizational structures and chain of command authority prevent its application.

by Art McNeil LSI publisher

Outdated attitudes, habits, and methods (holdovers from the industrial-age) are too slow. They reduce the ROI for investors and increase the risk of debt holders. Success in the shift age is dependent on customer and investor perceptions of value. Companies that deliver service without profit and vis versa are destined to fail. Continuing to offer products or services not valued by the customer, not eliminating waste and rework, and doing the right thing but at the wrong time, are disaster triggers.

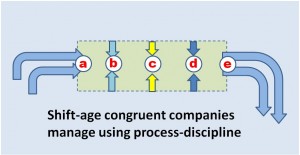

To be effective, executives must have a process that allows them to regularly assess where and when to invest or divest. Businesses use equity and debt provided by funding partners to pay for a series of initiatives that they trust will produce a profit. Investment enters the business (a) in support of a transformation process that produces a product/service that customers will hopefully be willing to pay for (e).

When customers are delighted, they are predisposed to continue buying. If the product or service has been produced at a satisfactory profit, funding partners will be predisposed to continue investing. Profit from the value-adding process keeps the doors to business open. If either the customer or funding partners are not satisfied with output (e), they will stop buying and investing—causing the business to fail

Every business experiences constraints in production flow. Ignoring dysfunction inhibits performance, but eliminating roadblocks consumes valuable time and resources—reducing the potential of achieving customer satisfaction and delivering a satisfactory return on investment. Left unaddressed, this is a venture (and career) ending double-bind. Goldratt’s Theory of Key Constraint offers a solution.

In the diagram above, (b), (c), and (d) represent production flow constraints. If time and money is applied to eliminate (b) or (c), there will no immediate payback because (d) is the key constraint. A key constraint is the main bottleneck that inhibits the ROI. of customers and funding partners.

Working on (b) and (c) is a potentially fatal misallocation of human and financial capital. Because of (d), there will be no immediate customer benefit, and capital will have been needlessly expended.

In the past, managers worked impediments to six sigma (a mathematical definition of perfection used by quality aficionados). Following the Theory of Key Constraint, working (d) will eventually improve flow until (a) takes over as the new key constraint. Management must be aware of what’s going on in order to redirect investment—relinquishing all thought of seeking six sigma (perfection) with impediment (d).

Cash is to business what oxygen is to human beings. It doesn’t matter how fit you are—if oxygen isn’t available, just a few minutes means certain death. To survive, cash must be readily available on a moment’s notice. That’s why spending on the elimination of impediments must be regulated—dealing first with key constraints that will pay off quickly.

In the shift-age, the timing of expenditures is critical. During speaking engagements I often ask, “How many of you would like to improve what you do?” Almost every hand rises to the affirmative. People are shocked when I suggest they could use a corporate exorcist to cast out industrial-age thinking. To survive, priorities must shift from questions like “What can we improve?” to “What can we stop doing altogether?”

The Baton Management System is shift-age congruent because it:

- is based on Goldratt’s theory of Constraint

- moves away from mangement by personal authority, and towards managing with process discipline .